So, you bought your first cryptocurrency based on your friend’s recommendation – but purchased at the wrong time, and now you’re looking at a paper loss? Don’t let that unrealized cryptocurrency loss sit there — put it to work for you at tax time.

Because the IRS treats cryptocurrencies as investment properties — like a stock or bond — they are subject to capital gains taxes. Under the IRS’ crypto tax guidance, users must record each transaction and compute the aggregate capital gain or loss each year for tax purposes. While nobody enjoys experiencing a loss, wise investors can leverage them to offset short-term capital gains elsewhere in their portfolio — or even offset up to $3,000 of their income.

Let’s look at how this strategy, known as Crypto tax-loss harvesting, works and the unique rules that apply to cryptocurrency investors.

What is Tax Loss Harvesting?

Tax-loss harvesting is selling a cryptocurrency that has experienced a loss to “realize” – or “harvest” – that loss. By doing so, you can offset taxes on both gains and income. You can then replace the cryptocurrency you sold in your portfolio with the same — or similar — asset to maintain an optimal asset allocation.

Harvest losses can offset capital gains and up to $3,000 in annual taxable income. If your losses exceed $3,000 and any capital gains for the year, you can roll the losses forward to future years and offset those gains. For instance, if you have $5,000 in losses and no capital gains, you may be able to offset $3,000 in taxable income this year and $2,000 next year.

Let’s look at an example:

Suppose you bought an altcoin for US$10,000 in February 2020, and it’s worth only US$6,800 today, representing a 32% unrealized loss. You could harvest the loss by selling altcoins and use that $3,200 to offset other taxes you owe this year or carry those losses forward to next year.

By some estimates, tax-loss harvesting can increase after-tax annual returns between 0.15% and 0.25% per year. And these figures can jump to nearly one percentage point during volatile years!

Did you know: Why Now May Be the Time for Crypto Tax-Loss Harvesting

Crypto tax-loss harvesting enables investors to strategically sell assets at a loss during market downturns or at the year’s end to reduce their tax obligations. They can sell any amount of assets and deduct up to $3,000 to offset their ordinary income on federal taxes. Additionally, remaining losses can be carried forward into subsequent tax years for further deductions.

What If You Didn’t Have Losses for the Year?

If you’ve accrued gains from crypto trading, but have losses in other financial asset classes (such as stock or bonds), you can leverage these losses to offset your crypto gains. And, if you have unrealized losses in these asset classes, you might consider harvesting those losses to offset your capital gains (and up to $3,000 in ordinary income).

That said, keep in mind that the Wash Sale Rule may apply to these other asset classes. For example, when you harvest losses by selling an ETF position, you cannot repurchase the same ETF within 30 days. But you may be able to purchase a similar ETF to maintain your overall asset allocations.

Tax Loss Harvesting Rules

Tax-loss harvesting for crypto might seem too good to be true. After all, what’s stopping you from selling every time the price drops to lock in a loss and offset gains as the price rises?

The Wash Sale Rule states that if you sell a security at a loss and buy the same or a “substantially identical” security within 30 days before or after the sale, the loss typically isn’t allowed for current income tax purposes. In the stock market, this rule prevents investors from constantly harvesting tax losses within their portfolio and limits the potential tax advantages of the strategy.

But, while these rules apply to stocks, the IRS considers cryptocurrencies “property” rather than “securities.” So, under the current law, the Wash Sale Rule does not apply to crypto investors. And, if the Wash Sale Rule were to apply, it would be challenging to determine what’s “substantially identical” since it’s not as straightforward as a stock or similar security.

Despite the potential for substantial tax savings, cryptocurrency investors should try not to abuse the strategy. The IRS could argue that an immediate sell-buy transaction had no substantive economic value and could not be used to offset capital gains or income. And, even if the IRS doesn’t win the fight, the cost of the battle might outweigh the benefits.

It’s also worth noting that these rules could change quickly. In 2021, a House Ways and Means Committee proposal included language that would have applied the Wash Sale Rule to digital assets. In March 2022, Biden signed the Build Back Better Act into law and effectively called for federal agencies to consider regulating crypto wash sales.

In addition to the Wash Sale Rule, the IRS restricts the specific types of losses you can use to offset certain gains. You would first apply the long-term loss to a long-term gain and a short-term loss to a short-term gain. You can apply excess losses to either gain if you have excess losses in one category.

Coming Up with a Strategy

Crypto traders and investors could theoretically harvest tax losses in real time, but you may want to consider a more conservative strategy to avoid catching the IRS’ attention.

There are two ways to comply with the “spirit” of the wash sale rule:

- You can wait 30 days to repurchase a cryptocurrency after selling it for a loss. That way, you’re complying with the Wash Sale Rule.

- You can realize the loss by exchanging the cryptocurrency for another highly correlated crypto asset, then hold that asset for 30 days and repurchase the original cryptocurrency. As long as the coins aren’t “substantially identical,” the transaction wouldn’t violate the Wash Sale Rule.

You can also optimize the impact of Crypto tax-loss harvesting by choosing the correct cost basis accounting method. While most people opt for the default first-in, first-out (FIFO) method, the “specific identification” method is the most tax-efficient. Rather than matching each sale with the earliest purchase, you can choose what transactions you want to match up to maximize the loss.

Let’s look at an example:

Suppose you purchased one BTC for $10,000 in January, one BTC for $20,000 in February, and one BTC for $15,000 in March. In April, the price of BTC drops to $12,000, and you decide to sell one BTC.

The FIFO accounting method would match your sale to the first purchase for $10,000. As a result, you would have a capital gain of $2,000 ($12,000 – $10,000 = $2,000) and owe tax on that gain. But if you use specific identification, you can match the $12,000 sale to the $20,000 purchase, resulting in a harvestable $8,000 loss ($12,000 – $20,000 = -$8,000). You can use that loss to offset other capital gains or up to $3,000 in taxable income (or carry forward additional losses into the future).

The downside of the specific identification approach is that it requires diligent record-keeping. When completing your taxes, you must provide a transaction ID for each matching transaction and keep track of them across years to avoid any mismatches. As a result, many crypto traders may prefer to use last-in, first-out (LIFO) or highest-in, first-out (HIFO) depending on their situation since it involves less tax preparation than specific ID.

It’s important to note that you must be consistent year to year, and between your tax-loss harvesting for crypto and your reporting on your 8949 or Schedule D, You cannot switch between these — you have to choose one and stick with it. If you want to switch methods, you must typically file Form 3115 and indicate how you plan to make the change.

Ultimately, it’s a good idea to talk with your accountant regarding a crypto tax-loss harvesting strategy, leverage crypto tax software to help keep everything organized, and employ a conservative approach to avoid running afoul of current or future tax laws.

How ZenLedger Can Harvest Your Losses?

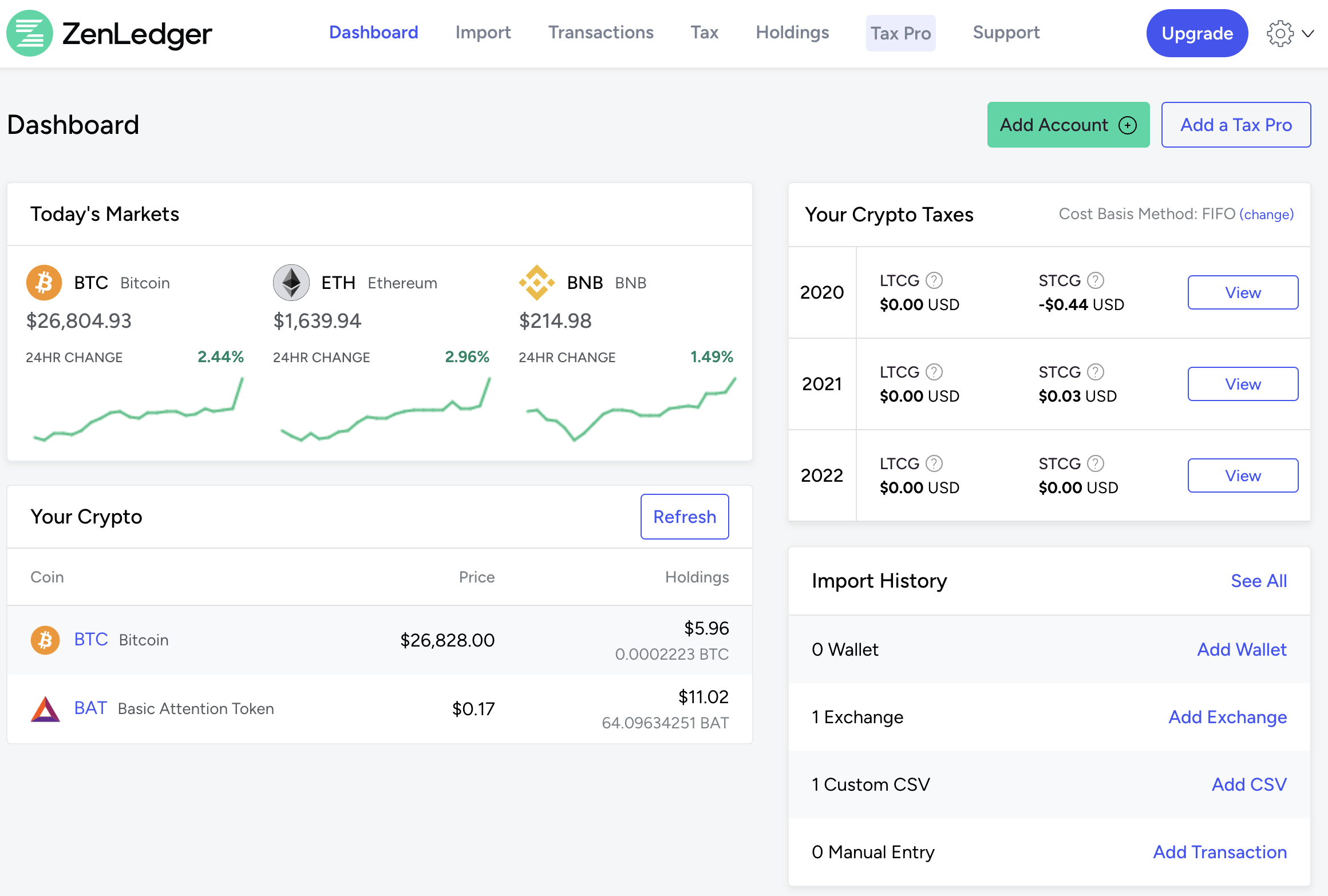

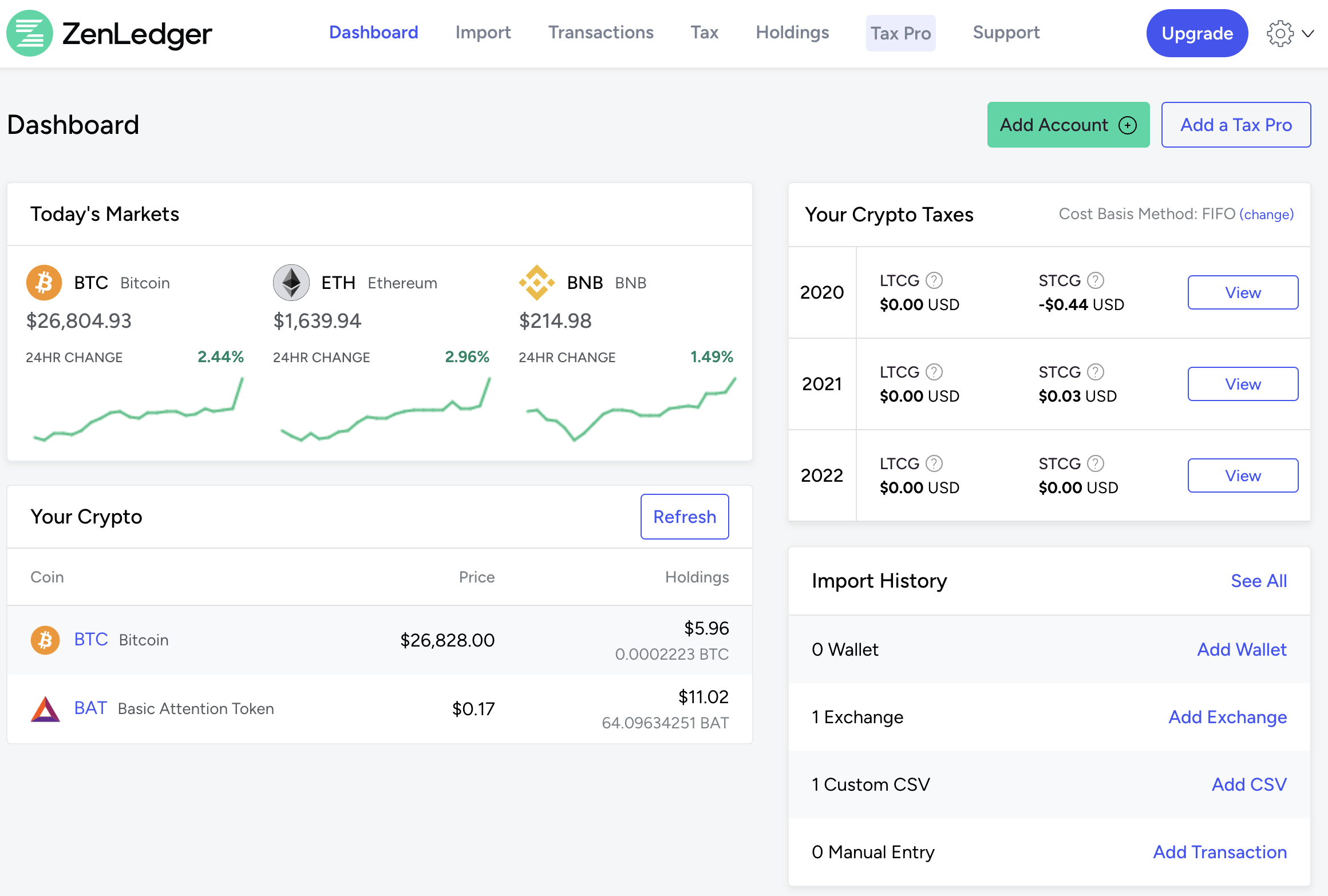

ZenLedger helps investors automate their tax-loss harvesting by identifying opportunities with our tool. When you import your transactions (from your various exchanges and wallets) into the ZenLedger platform, it finds every opportunity for savings and auto-fills popular IRS forms. Our tax-loss harvesting tool is free to use with all tax plans.

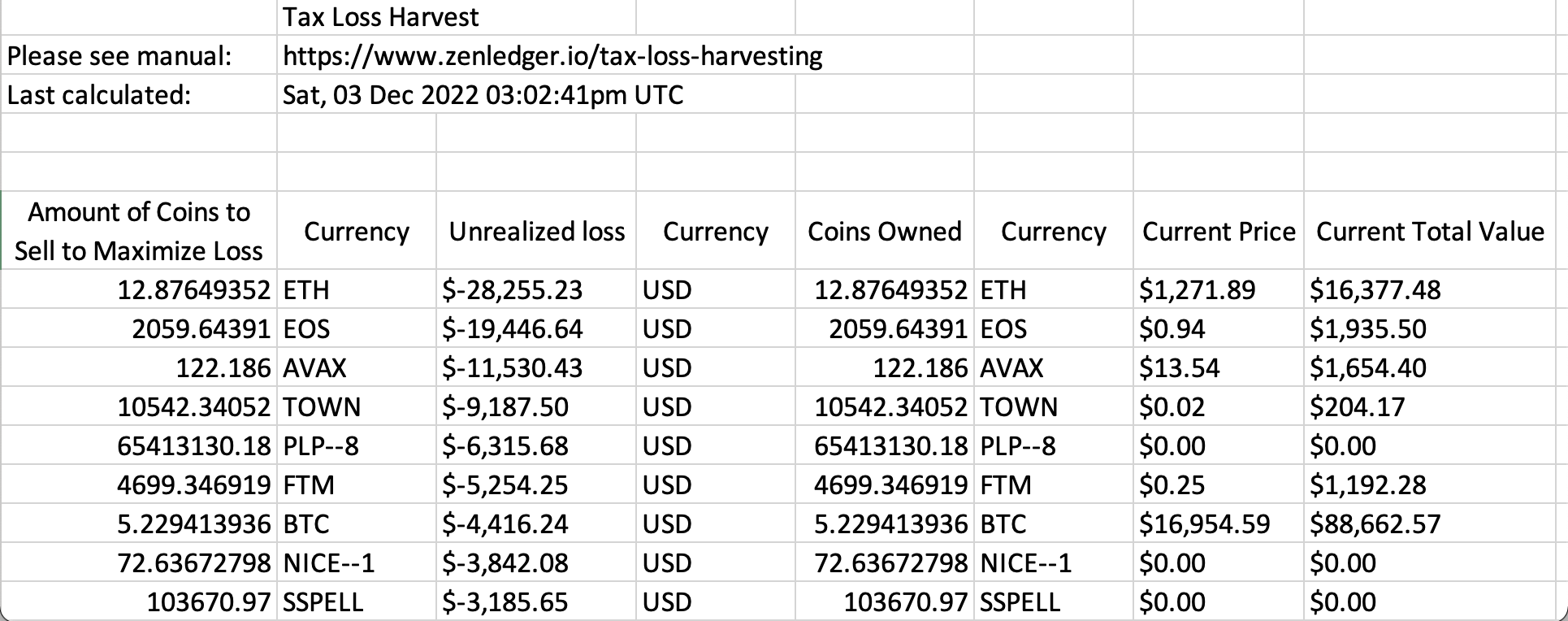

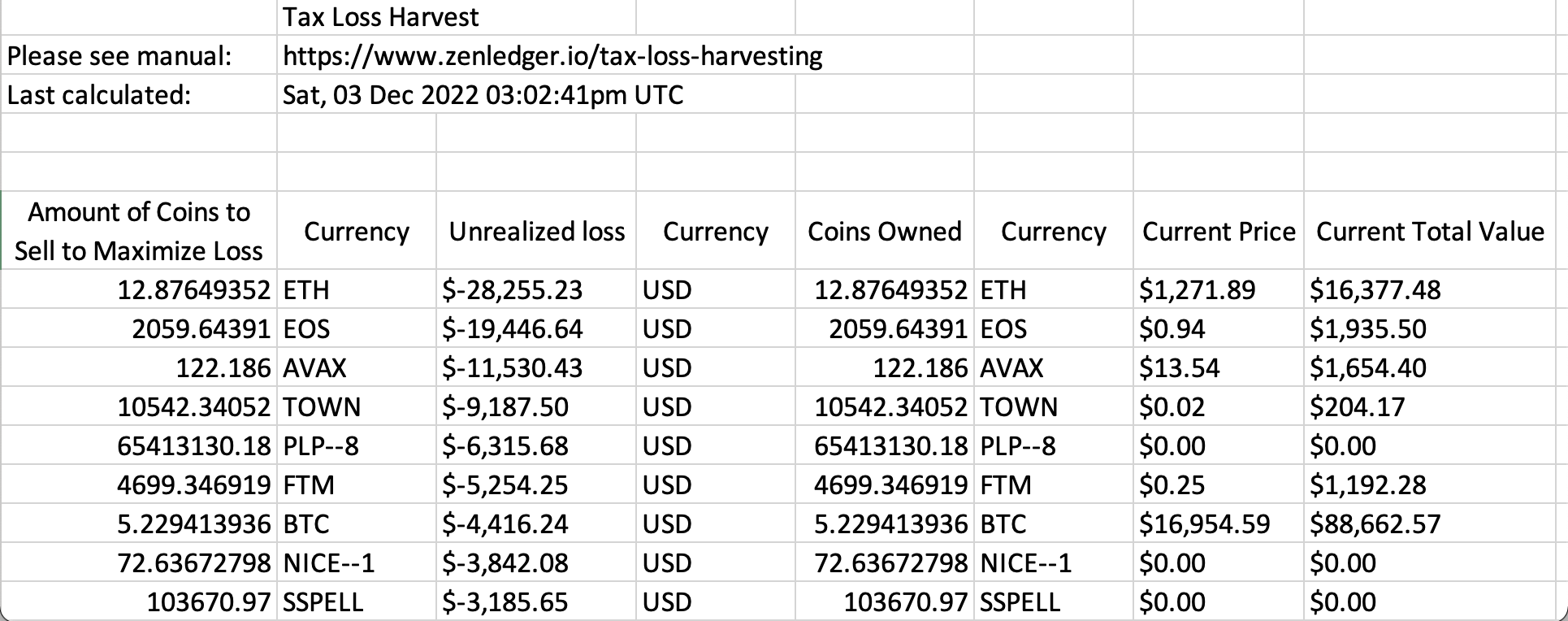

The platform generates a spreadsheet containing tax-loss harvesting opportunities based on the transactions in your account and your preferred accounting method. You can also see the differences between strategies, which can help you decide whether it’s time to switch.

How to Claim Crypto Losses on Taxes with ZenLedger?

Our tax-loss harvesting tool lets you know how many unrealized capital losses you have in each token type. Then, you can decide if you want to sell the positions and realize the loss or determine how much you want to offset your capital gains or other ordinary income.

Step 1: Launch the Tool

Start by signing into ZenLedger and importing your transactions. After you have transactions, click on Tax in the top menu and then look in the Utilities box for the Tax Loss Harvesting option. You can then run the tax-loss harvesting tool to generate the spreadsheet.

Step 2: Read the Results

Click the Download Spreadsheet button to download the spreadsheet when it’s ready.

Each tab represents a different accounting method — use your preferred method (most customers use FIFO, but HIFO and LIFO are also available) to see your total potential losses to harvest, organized by cryptocurrency. You can toggle between accounting methods in the spreadsheet using the tabs at the bottom of the screen.

The summary tabs show you all the cryptocurrencies you own with unrealized loss using your preferred accounting method. Meanwhile, the other tabs show you the raw data we use to create your summaries, enabling you to see the actual transactions.

Step 3: Realize Losses by Selling Your Crypto Once

The tax loss harvesting spreadsheet tells you what losses you can harvest, but it’s up to you to take action. But, the platform doesn’t provide direct access to execute the transactions because these coins aggregate across all your exchanges and wallets. Instead, you must sign in to each coin’s exchange or wallet location and complete the transactions.

Share this data with your tax professional to decide on the best approach, or log in to your exchange(s) and sell your coin(s) to harvest the losses yourself. For example, you may only want to harvest some losses. Or, avoid selling long-term positions since the clock resets on your capital gains tax rate.

To learn more about the rules and requirements around crypto tax-loss harvesting, watch our 22-minute on-demand webinar with Pat Larsen, CEO and co-founder of ZenLedger, and Andrew Gordon, JD/CPA, President of Gordon Law Group, Ltd.

“…it’s not just crypto, but crypto is a very liquid investment for crypto tax-loss harvesting. After realizing the loss, investors can purchase a similar asset to maintain optimal asset allocation and expected returns.” – Andrew Gordon, JD/CPA, President of Gordon Law Group.

How Often Should You Harvest Crypto Losses?

The Wash Sale Rule doesn’t technically apply to cryptocurrencies, which means it’s theoretically legal to sell losing positions to harvest losses constantly. While that may seem like a loophole, there are a few reasons to take a more balanced approach.

First, buying and selling cryptocurrencies involves transaction costs at the exchange and blockchain levels. For example, Coinbase typically charges a taker fee of 0.05% to 0.6% and a maker fee of 0% to 0.04% or a flat fee, depending on your customer type. You may also have to pay a spread between the bid and ask prices. So, the benefit of harvesting the loss must outweigh the cost of selling and buying a position.

Second, while the Wash Sale Rule doesn’t apply to cryptocurrencies, the IRS generally expects that transactions should have economic substance or a valid purpose to consider them for tax deductions. The Economic Substance Doctrine is a principle the IRS uses to deny tax benefits for transactions that don’t accomplish any meaningful purpose other than generating a tax loss. And if you harvest losses too frequently, you risk running awry of these shadow rules.

So, how often should you harvest tax losses?

Many investors wait until the end of the fiscal year to check their crypto investments and determine their unrealized losses to lower their tax bills. But that’s a mistake. If a cryptocurrency falls sharply between January and June and barely recovers by December, you’ve missed an opportunity to harvest a loss. So, it’s essential to regularly track your unrealized losses throughout the year and act when it makes sense.

ZenLedger makes it easy to track your crypto portfolio throughout the year. When prices start falling, you can re-run the tax loss harvesting tool to generate a list of opportunities to lower your tax burden. Then, you can return to the ZenLedger portfolio tracker to see where you can find the coins to place sell and future repurchasing transactions.

Crypto Tax-Loss Harvesting Risks

Crypto tax-loss harvesting is an essential strategy for any crypto trader or investor, but there are several caveats to remember.

The most significant risks include:

- Regulatory Uncertainty – The IRS has not clarified whether the Wash Sale Rule applies to cryptocurrencies, meaning these transactions could be subject to future scrutiny. In addition, legislators have clarified that they want regulators to close the loophole and treat cryptocurrencies like stocks.

- Tax Complexity – Tax-loss harvesting adds complexity to your tax preparation. Fortunately, you can use tools like ZenLedger to find opportunities for tax-loss harvesting, automate the reporting of those transactions, and generate the tax forms you must file each year.

- Transactions Costs – Buying and selling cryptocurrencies typically involves fees. While these fees are deductible, you should ensure you’re realizing a net benefit from tax-loss harvesting transactions. Some cryptocurrencies may also not be liquid enough for efficient tax-loss harvesting since it may be challenging to reacquire at an attractive cost.

- Tax Treatment – Selling long-term positions to harvest tax losses resets the clock on capital gains taxes. If the repurchased asset appreciates, you may be unable to sell the asset and pay the lower long-term capital gains tax rate.

- Economic Substance Doctrine – The IRS could question transactions that don’t have economic substance, potentially denying deductions claimed through those transactions.

What Advantages Does Crypto Tax Loss Harvesting Offer?

In addition to minimizing Capital Gains Tax liability, engaging in crypto tax loss harvesting presents several other advantages. Notably, in the United States, individuals can offset up to $3,000 of capital losses against ordinary income annually, effectively reducing their overall tax burden. Furthermore, if your portfolio experiences losses exclusively, you can carry these losses forward to offset against gains in future financial years, providing a means to decrease tax obligations in subsequent periods.

What are the Potential Drawbacks of Engaging in Crypto Tax Loss Harvesting?

As long as you adhere to the wash sale rules and avoid violating the economic substance test, you shouldn’t fret about facing scrutiny from tax authorities. Crypto tax loss harvesting is entirely legal.

Nevertheless, there are some disadvantages to consider. Frequent buying and selling of cryptocurrencies result in increased transaction fees, which can reach up to 4% per transaction on certain exchanges. Therefore, it’s crucial to factor these fees into your calculations to ensure that transaction costs don’t overshadow the tax savings you achieve.

Additionally, if you repurchase the asset after selling it for tax loss harvesting purposes, you may inadvertently trigger a larger Capital Gains Tax liability in the future by reducing your cost basis at the time of repurchase.

Which Cost-basis Method Should be Used for Crypto Tax Loss Harvesting?

Selecting the appropriate cost basis method during tax loss harvesting can significantly impact your outcomes, and U.S. investors are fortunate to have multiple options available.

The IRS permits various cost basis methods under the Spec ID cost basis method for calculating crypto taxes, including FIFO (First In, First Out), LIFO (Last In, First Out), and HIFO (Highest In, First Out). U.S. investors should carefully evaluate which cost-basis method aligns best with their crypto tax strategy. Koinly offers assistance in this regard, allowing users to adjust their cost basis method in settings and observe how it affects capital gain and loss calculations for the year. Additionally, users can utilize Koinly’s free crypto tax loss harvesting tool to identify which assets to dispose of.

You Should Know: Nathan Goldman Explains the Importance of Tax-loss Harvesting

Is Crypto Tax-loss Harvesting Considered Tax Evasion?

No, tax loss harvesting in crypto is entirely legal. However, it’s crucial to adhere to the wash sale rules in your jurisdiction to ensure that you can legitimately offset your capital losses. For further information on what constitutes illegal activity, refer to our guide on crypto tax evasion.

What About Short-term vs. Long-term Gains in Crypto Tax-loss Harvesting?

In the United States, different rates of Capital Gains Tax apply to short-term and long-term gains, which is significant because the IRS advises offsetting gains and losses of similar durations against each other in sequence. Consequently, your priority should be to offset short-term losses with short-term gains initially, then proceed to balance long-term losses against long-term gains, and continue this process accordingly.

However, if there are any remaining capital losses afterward, you can utilize them to offset capital gains of the opposite type. Hence, understanding the duration for which you’ve held the crypto you’re considering disposing of for tax loss harvesting purposes is crucial, as strategic planning could lead to substantial reductions in your tax liability.

Is Tax-loss Harvesting Applicable to NFTs?

Absolutely! It’s highly recommended. With many investors experiencing substantial losses from the NFT market following the decline in hype, engaging in NFT tax loss harvesting can be advantageous. We offer a comprehensive guide on NFT tax loss harvesting, providing valuable insights, including tips on disposing of NFTs in illiquid markets.

The Bottom Line

Tax-loss harvesting is a great way to leverage unrealized losses to offset short-term capital gains or income. Since crypto sales aren’t currently subject to wash sale rules, the strategy has a minimal downside, and you could use it to realize a significant increase in after-tax returns. The key is exercising some discretion and using tools like ZenLedger to help.

ZenLedger easily calculates your crypto taxes and also finds opportunities for you to save money and trade smarter with our portfolio tracker. Get started for free or learn more about our tax professional prepared plans!

Disclaimer: This material has been prepared for informational purposes only and is not intended to provide tax, legal, or financial advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.