The rise of decentralized applications on the Ethereum network has allowed investors and traders to trade without any financial intermediary. Keeping this in mind, Fernando Martinelli and Mike McDonald in 2018, founded Balancer. Balancer protocol is one such decentralized finance (DeFi) that targets to scale up the liquidity between coins, tokens, and blockchains.

Balancer has its own custom cryptocurrency called BAL, which is rewarded to users who add to the liquidity of Balancer pools. But what is Balancer and how to buy Balancer crypto? Let’s find out.

What is Balancer?

Balancer is a decentralized finance (DeFi) protocol on the Ethereum blockchain that enables users to create and manage customizable liquidity pools with multiple tokens. These pools can automatically rebalance assets to maintain predefined proportions, and users earn fees from trading within these pools. Balancer’s flexibility and decentralized nature make it a popular choice for DeFi participants seeking efficient asset management and decentralized trading.

Connecting Your Balancer Account To ZenLedger

- To import your transactions, log in to Balancer and copy your receiving address.

- Paste the receiving address you copied from Balancer into the wallet address field in ZenLedger.

- Select the proper coin from the dropdown list.

- Select if the wallet is based in the USA or not.

- Then hit add a coin.

How are DeFi protocols like Balancer taxed?

Taxation of DeFi protocols like Balancer varies by jurisdiction, and it can be complex. In general, capital gains tax may apply to profits from trading or swapping tokens within DeFi platforms, and income tax may be levied on earnings from providing liquidity or participating in yield farming. Proper record-keeping and staying updated with changing tax regulations are essential.

Learn more about Cryptocurrency taxes: How is Cryptocurrency Taxed?

How To Generate Balancer Crypto Tax Forms with ZenLedger?

Here are the steps to report your Balancer transactions on your tax return using Zenledger:

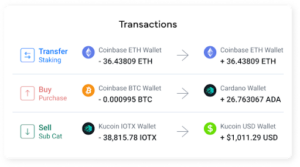

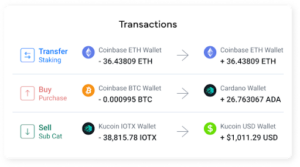

1. Connect and Import: Connect your Balancer wallet to Zenledger and import your transaction data. Zenledger will automatically categorize your transactions as buys, sells, swaps, or liquidity provisions.

2. Review and Classify: Review the imported transactions, make sure they are accurately categorized, and provide additional information as needed, such as cost basis and acquisition dates.

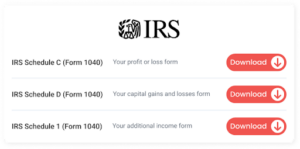

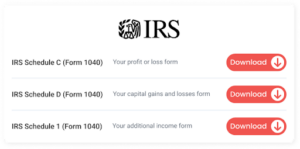

3. Generate and File: Use Zenledger to generate the necessary tax reports and calculate your tax liability. Download the tax forms, such as Form 1040 Schedule D, and file your tax return according to your jurisdiction’s regulations.

How To Buy Balancer Crypto Tokens (BAL Tokens)?

Let’s get started with how to buy Balancer crypto using three simple steps.

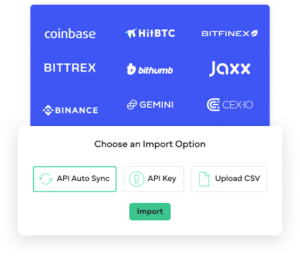

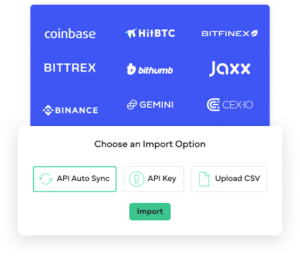

1. Create An Account

Start by opening an account with an exchange that supports Balancer (BAL) token. Although Balancer is not as sought-after as compared to Ethereum, Bitcoin, and the likes, there still are several brokers that deal with the supply of BAL. These brokers will provide access to a trading platform for buying and selling crypto in lieu of a small commission or trading fees.

2. Add A Wallet

A long-term crypto investment requires long-term security. Hence, getting a private cryptocurrency wallet is crucial before you make your first purchase. This crypto wallet stores your private key and keeps your coins and tokens secure and accessible. The chances of hacking and phishing are brought down with using a crypto wallet.

There are many wallets you can choose from, but Balance is an ERC-20 token. Thus, you can keep your BAL tokens in a wallet that is compatible with the Ethereum network.

3. Start Buying

Before buying your tokens, it is recommended to check Balancer’s current market price and then decide on the number of tokens you’ll add to your portfolio. Next, through the trading platform of the broker, choose the number of tokens you’ll purchase and place a limit order. The rest will be taken care of by the broker, who will fill the order as per your set parameters. Once the order is filled, your BAL tokens will reflect in your wallet.

How Does Balancer (BAL) Work?

An index bond is a portfolio of different bonds or stocks. Similarly, the Balancer pool is composed of eight different currencies. The value of this Balancer pool is measured by how many tokens there are within it.

Self-Balancing Index Fund

Balancer relies on smart contracts which ensures that the correct proportion of assets is retained in each pool. This applies even if there is a variation of coin prices in the pool.

Balancer Pools

Balancer caters to investors with varied risk appetites by offering both public and private pools.

In a public Balancer pool, a user becomes a liquidity provider as they add or withdraw assets. The pool has preset parameters that are not changeable before they are launched. Users with small holdings who can earn from the most liquid pool will benefit from the public pool.

Unlike a public pool, users can add or withdraw assets in a private Balancer pool. The parameters, such as asset type, weightings, and fees can be adjusted by the user as well. These private pools are more useful for users with large portfolios who wish to earn on a specific asset.

An important type of private pool is smart pools, which are owned by smart contracts. It adds more functionality to the pool, by allowing users to change weights, or create index funds that can be used to track a property portfolio.

The Bottom Line: Why Choose Balancer?

If you have an idle crypto portfolio, Balancer could be the right choice for you. Whether you are an active trader or portfolio manager, with Balancer you’ll have the opportunity to buy well-constructed units.