The market is filled with blockchain projects focused on decentralized applications and the conversion of tokens. Bancor Network, one of the most popular projects in the crypto space, is a group of smart contracts on Ethereum’s blockchain. A smart contract allows users to exchange their crypto in a truly decentralized exchange.

Bancor Network provides traders with automated liquidity for trades by the use of the Bancor wallet and Bancor Network Token (BNT). BNT token is an ERC-20 token that is built on Ethereum’s blockchain. It has two main roles:

- Providing chain liquidity

- Governing the protocol

This multifaceted role of BNT is pivotal in the operation and governance of Bancor Network. Now, Let’s look at how you can connect your Bancor account with ZenLedger.

Connecting Your Bancor Network Account To ZenLedger

- To import your transactions, log in to Bancor and copy your receiving address.

- Paste the receiving address you copied from Bancor into the wallet address field in ZenLedger.

- Select the proper coin from the dropdown list.

- Select if the wallet is based in the USA or not.

- Then hit add coin.

How Crypto Taxes Work?

Cryptocurrency taxes work by subjecting various cryptocurrency transactions, such as buying, selling, and earning income in cryptocurrency, to taxation. Capital gains tax is typically applied to profits made from selling or trading cryptocurrencies, with different rates for short-term and long-term holdings. Income tax is levied on cryptocurrency received as earnings or income. Accurate record-keeping, reporting to tax authorities, and staying informed about cryptocurrency tax regulations are essential, and consulting a tax professional is often recommended for compliance with local laws.

For more information, read this article: A Step-by-Step Guide to Crypto Taxes

Can Bancor Network Generate My Tax Forms?

Bancor’s reporting and data only cover transactions that occur within the Bancor platform. To accurately calculate your gains, losses, and income for tax purposes, you will need to account for all your cryptocurrency transactions, including those that involve external wallets, exchanges, DeFi protocols, and other platforms.

For a comprehensive view of your cryptocurrency tax liability, it’s essential to use cryptocurrency tax software such as ZenLedger or work with a tax professional who can aggregate data from various sources, including Bancor Network, to provide a complete picture of your crypto-related financial activities. This will help ensure accurate reporting and compliance with tax regulations for your entire cryptocurrency portfolio.

Steps to Report your Bancor Transactions using Zenledger

Here are the three simple steps:

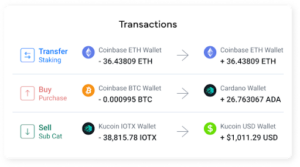

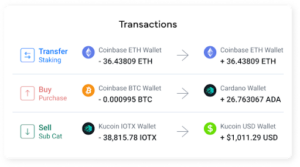

1. Connect and Import: Connect your Bancor wallet to Zenledger and import your transaction data, which includes swaps and liquidity provision activities.

How Does The Bancor Network Work?

Bancor operates as an Automated Market Maker (AMM) platform, facilitating cryptocurrency trades and liquidity provision in a decentralized manner. When a trade is executed on the platform, the system automatically converts the involved cryptocurrencies into BNT, which is the native token of the Bancor protocol. BNT serves as an intermediary in the trading process and supports the AMM system.

Liquidity providers play a crucial role in the Bancor ecosystem. These users deposit funds into liquidity pools on the platform, and in return, they earn rewards in the form of a percentage of the trading fees paid by traders on the network. This incentivizes users to contribute to liquidity and maintain the smooth operation of the protocol.

Cross-chain operations are a significant feature of Bancor, enabling the platform to connect with other blockchain networks, such as Ethereum and EOS. This cross-chain compatibility enhances interoperability and expands the reach of the Bancor Network, allowing users to access assets from multiple platforms.

One unique aspect of Bancor is its single-token liquidity provision. Unlike many other DeFi protocols that require users to provide token pairs, Bancor allows users to add a single token to a liquidity pool. This approach simplifies the process of providing liquidity and makes it more accessible for users.

In addition to BNT, the system introduced another token called ETHBNT with the second version of the protocol in 2020. ETHBNT represents shares of BNT and ETH in Bancor/Ethereum pools, further enhancing the platform’s liquidity and utility.

Bancor’s AMM-based approach, cross-chain compatibility, single-token liquidity provision, and the use of tokens like BNT and ETHBNT contribute to its unique position in the DeFi ecosystem, offering a user-friendly and efficient platform for token exchanges while also supporting liquidity and interoperability.

How To Buy Bancor Network Token (BNT)?

Let’s get started with how to buy Bancor Network Token (BNT) using three simple steps:

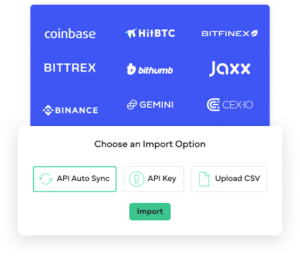

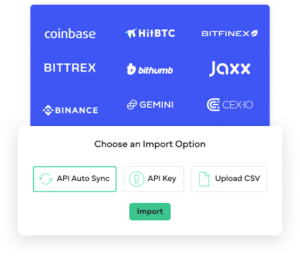

1. Create An Account

You need not necessarily use the Bancor exchange for buying BNT tokens. There are plenty of centralized exchanges that support Bancor, such as Binance, Bittrex, and Coinbase. If you have a cryptocurrency brokerage account, centralized exchanges will be an easier option for you. You’ll have to provide you information such as name, email address, phone number, Social Security number (SSN), and address for verification. For decentralized exchanges like Bancor and Uniswap, you have to connect your Ethereum wallet.

Coinbase is the most chosen decentralized exchange among all exchanges for buying Bancor Network Token (BNT).

2. Add Your Wallet

After the creation of your account, you must store your tokens securely away from hackers. For this, you can either choose to store the tokens on the same exchange from which you bought BNT or on private crypto wallets. The former is not a very secure option as it lacks the high-level security of software and hardware wallets. Most investors choose software wallets such as Coinbase Wallet and Metamask for their easy accessibility, but nothing beats the security offered by hardware wallets. Hardware wallets are offline devices where your crypto is stored.

3. Start Purchasing

Now that you’ve created your account and connect your wallet, it’s time to buy Bancor Network Token (BNT). Both centralized and decentralized exchanges can be used to purchase Bancor (BNT) tokens.

If you’re using centralized exchanges like Binance and Coinbase, you’ll have to create your account and place your order. But if you’re using decentralized exchanges, like Bancor and Uniswap you will have to add an extension of Ethereum wallet to your web browser. One of the best wallet extensions is MetaMask.

You can place either a market order or a limit order. In a market order, you can buy BNT at its current market value. In the case of a limit order, the price of BNT is determined by you.

Bancor Network Safe Staking

Safe Staking allows users to deposit their crypto tokens in a liquidity pool to earn a passive yield of profits without any risk of loss and single token exposure.

- You will only need to deposit one single token in the Bancor network instead of pairing 50/50 tokens with another asset (like ETH or USDC)

- Depositors can earn auto-compounding earn trading fees and are paid in the token they’ve already staked

The Bancor network protocol is designed in a manner such as to ensure the depositor gets back the same value deposited token + a trading fee and rewards. This is achieved by using a mechanism known as Impermanent Loss Protection (IL Protection).

It must be also noted that the IL Protection tracks the HODL value of all deposited tokens, which means, even if a token is to crash, the depositor is protected and entitled to withdraw the full invested value of the staked tokens

The Bottom Line: Why Choose Bancor Network?

If you aim to invest in virtual currency with good returns, Bancor can be a great option for you. The key features of Bancor Network are:

- Use of smart contracts to create a smart token

- Cross-chain conversion

- Built-in Automated Market Maker (AMM)

- Bringing in automatic liquidity