BATS by zenledger

Simplifying Cryptocurrency Investigations

The global leader in blockchain analytics & forensic accounting.

Investigate

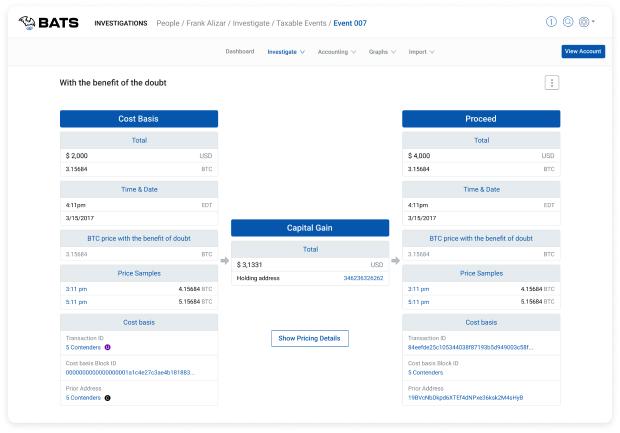

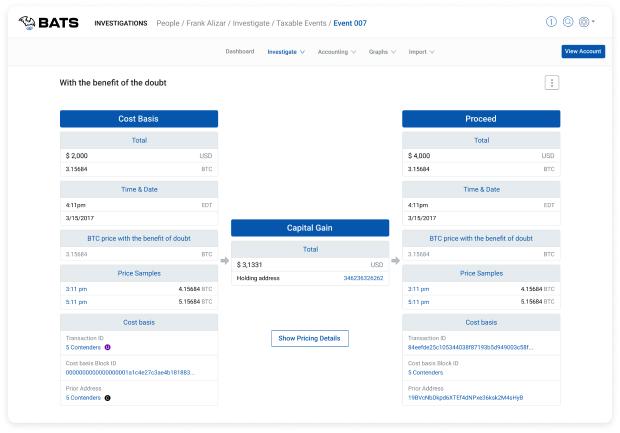

Crypto audits, investigations, income and capital gains tax collection.

AI-Empowered Investigation

Detect any unreported assets with AI empowered technology.

Full Visibility

Understand all sources of cryptocurrency assets and where they are incorrectly reported.

Advanced Tools And Resources

We work with federal and state investigators, enabling tax authorities to…

Create additional revenue streams through well established income and capital gains tax code.

Increase tax compliance and adherence to IRS standards.

Key applications of the BATS Approach centers around income/capital gains tax investigations for government revenue collection and financial crimes.

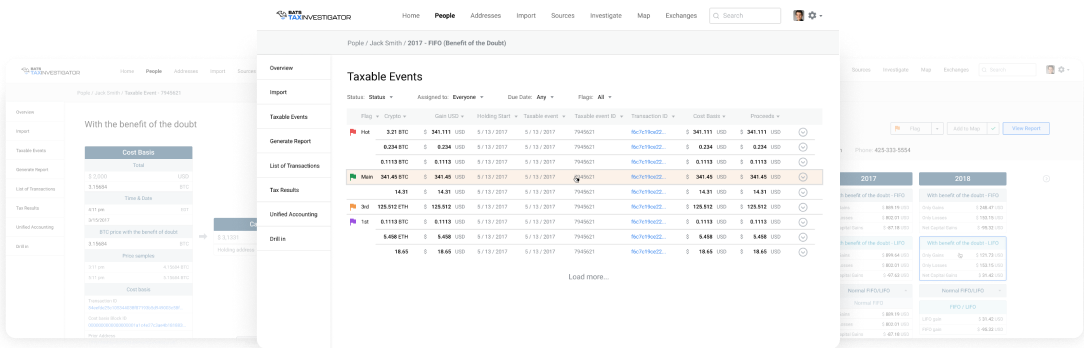

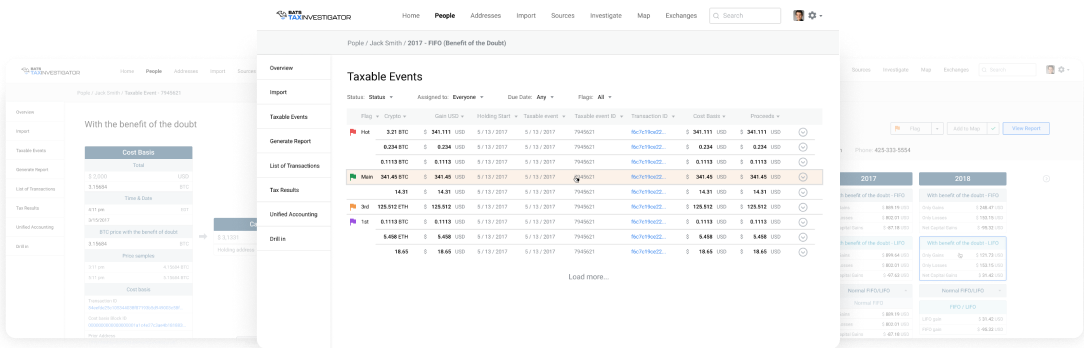

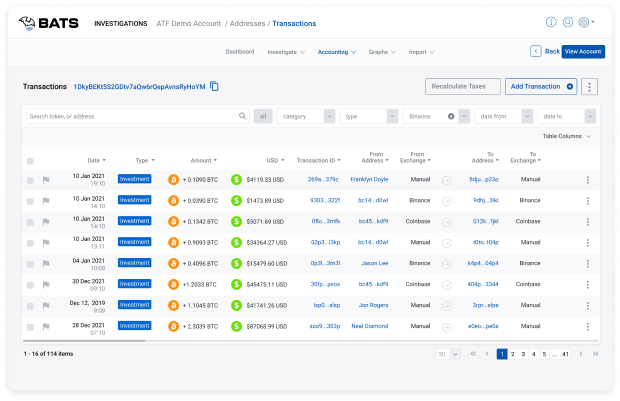

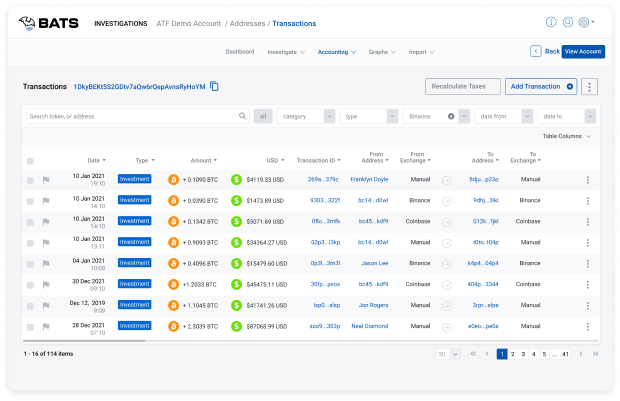

Automation and analysis of large amounts of cryptocurrency transaction data to save auditors and investigators time and wasted effort.

BATS efficiently generates transactional analyses for investigators otherwise difficult to derive reliably, given the complex transactions the targeted asset holders engage in.

Software will populate a map of transactions and accounts linking the flow of assets from one individual or case to another.

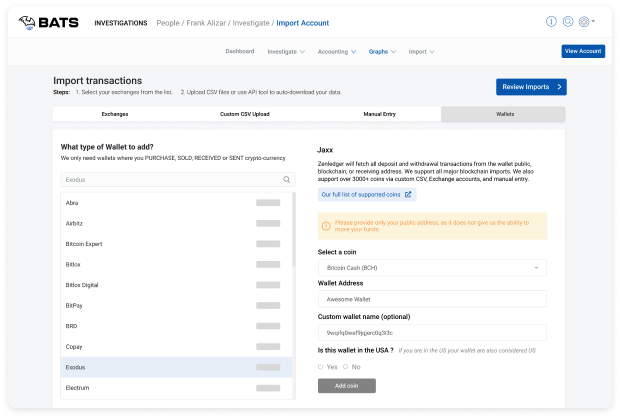

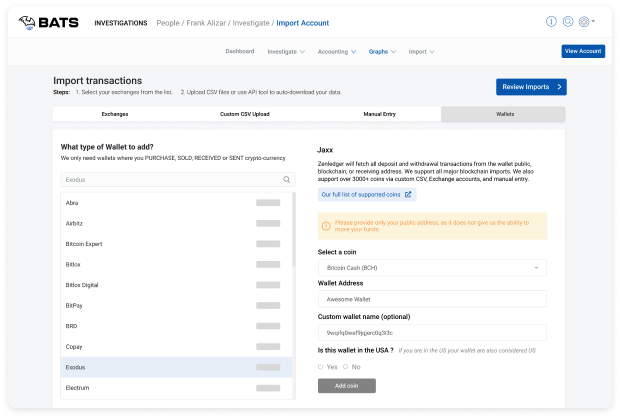

Import

Investigate

Understand

Our Mission

Ensuring cryptocurrency tax transparency and compliance by providing investigation agencies with a 100% visibility on tax compliance status of the potential suspects.

Why?

With BATS you can easily conduct in-depth investigations into the source of cryptocurrency transactions within seconds. Cryptocurrency compliance check and investigation are fast, easy and accurate.

How?

Our AI-empowered technology will detect unreported assets and find any violations, including those related to the requirements of FATCA and FinCen.