How ZenLedger crypto tax software works

Built by crypto traders for crypto traders.

1

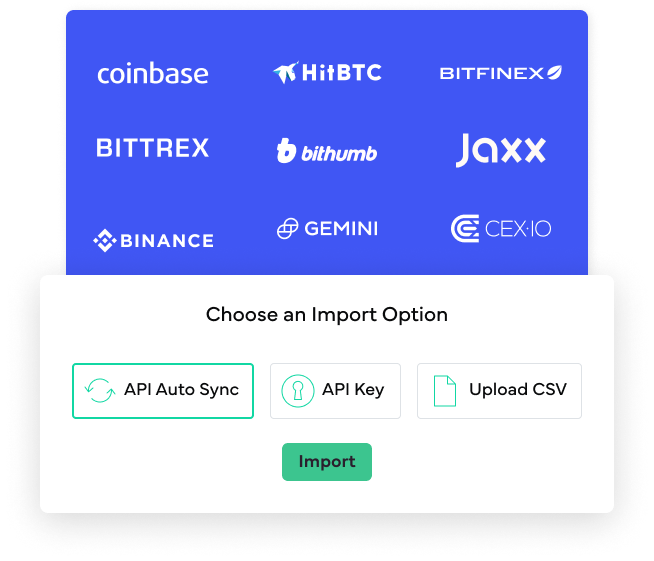

IMPORT

Connect to over 500+ crypto exchanges and wallets

Start by importing your crypto trading history from all years you’ve been trading, and from all exchanges and wallets into ZenLedger. ZenLedger will automatically calculate cost basis, fair market value, and gains/losses for your transaction history.

2

REVIEW

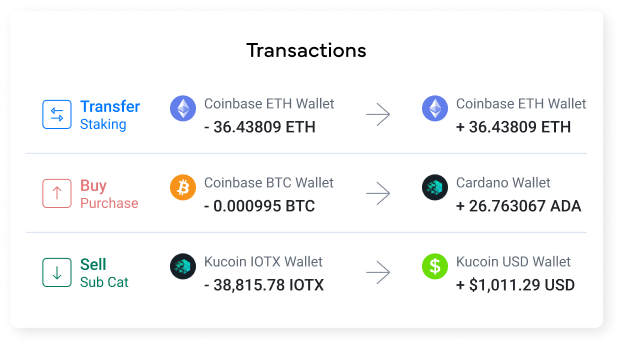

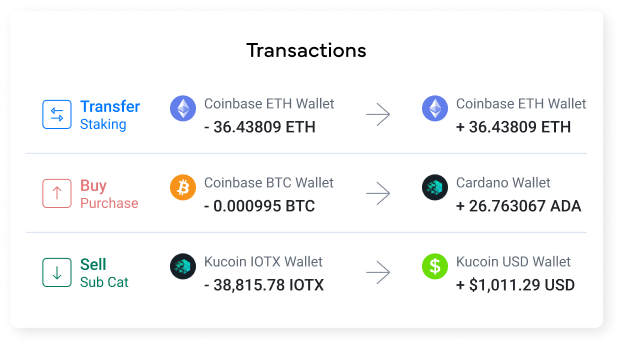

Review your crypto transactions

Easily calculate your capital gains and losses, and view tax liability for every cryptocurrency transaction. ZenLedger provides a resolution center to ensure that you’ve imported your information successfully. You can also review any historical cryptocurrency tax income such as mining, staking, lending, gifts, or even exchange rewards like airdrops and forks!

3

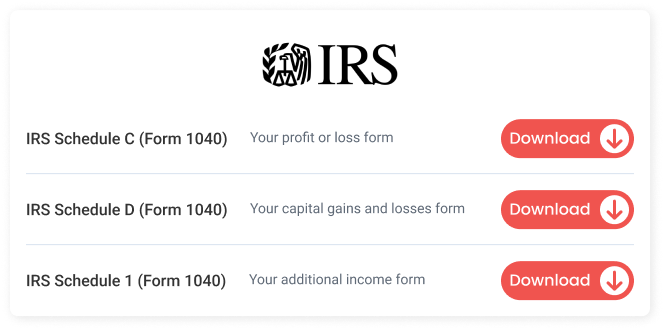

DOWNLOAD

Download and file your crypto tax forms

After reviewing your reports and ensuring accuracy, the final step is to generate your tax reports and file them! For each tax year, the following documents are automatically created: