Cryptocurrency Tax Professional Suite

Help your clients prepare and file their cryptocurrency taxes

Created specifically for tax professionals. Easily help your clients prepare and file taxes on their crypto investments with our software.

Create a new revenue stream

Expand your practice by bringing on new clients that are different from your existing client base. Save time and earn more revenue through ZenLedger’s automated tool.

Support existing clients with crypto investments

Your clients have to pay taxes on crypto and you need the tools to help them file. Avoid a big mess of sorting through thousands of crypto transactions and use our multi-client dashboard.

Stay IRS compliant

With the increased IRS enforcement on crypto taxes, and the virtual currency question moving to the top of the 1040 form for the 2020 tax year, you can’t avoid handling crypto taxes if you want to stay compliant.

BENEFITS OF ZENLEDGER TAX PRO SUITE

We have the most advanced tools to help your clients predict their tax liability and harvest their tax losses.

Pricing

There is no cost to the tax professional. Your client pays us or you bill your client. There's no software cost or subscription fee.

Superior Customer Support

Our customer support team can help via live chat, email, or phone support, 7 days a week.

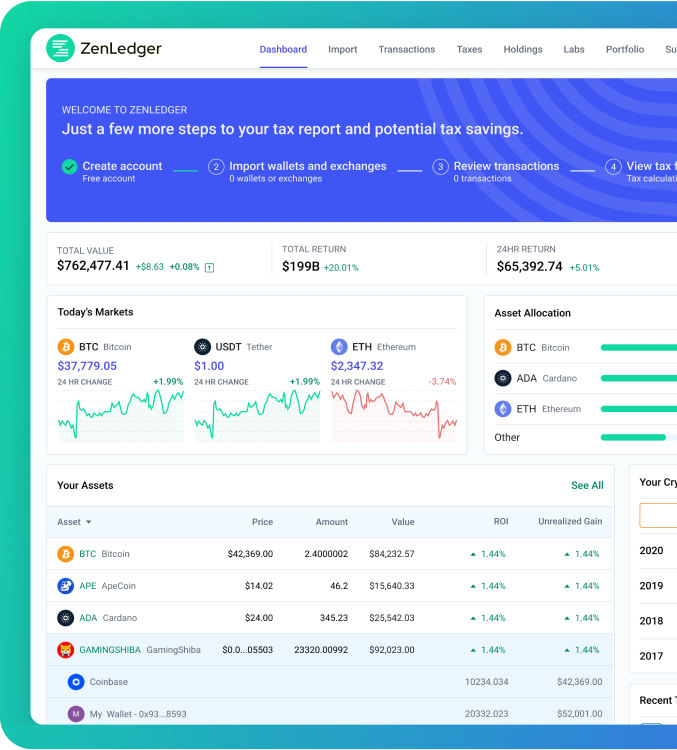

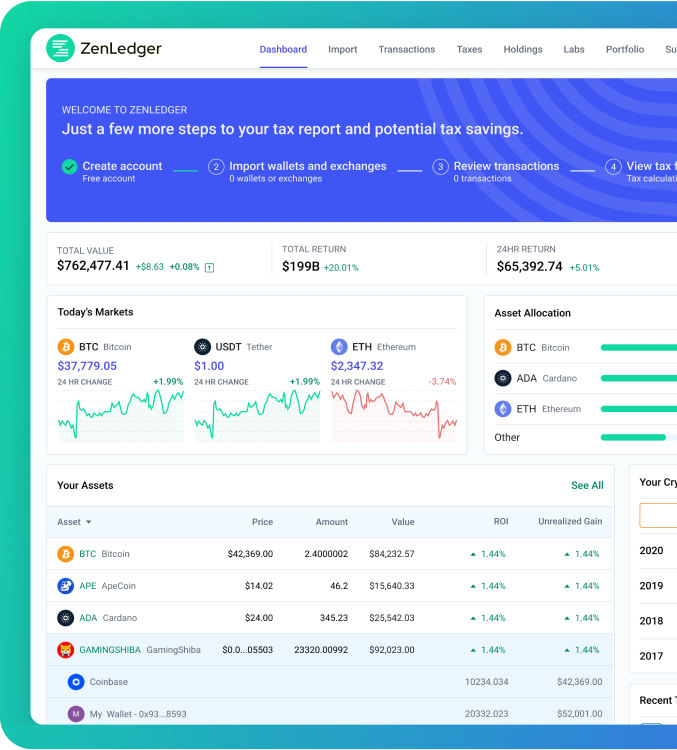

Client Management

Keep track of all of your client’s crypto transaction history and tax forms in one, easy to use dashboard. See and audit their buy, sell, trade, and transfer history.

Fully Automated

Easily import your client’s transaction data via CSV or API, and calculate their crypto taxes within the ZenLedger platform. Then download their forms and file. Easy!