One tax return.

One platform experience.

No more tab toggling.

Additional important legal and coverage information.

The end-to-end tax experience for crypto traders you've been waiting for.

Create an account

Easily create an account in seconds

Import your crypto tax totals

Import your crypto tax totals with a single click

Upload your documents

Upload your documents and answer a few questions

Maximum Refund Guarantee*

Your trust is our priority. Rest easy knowing that your return is the best it can be. *Limitations apply; see below.

april is an IRS authorized e-File provider

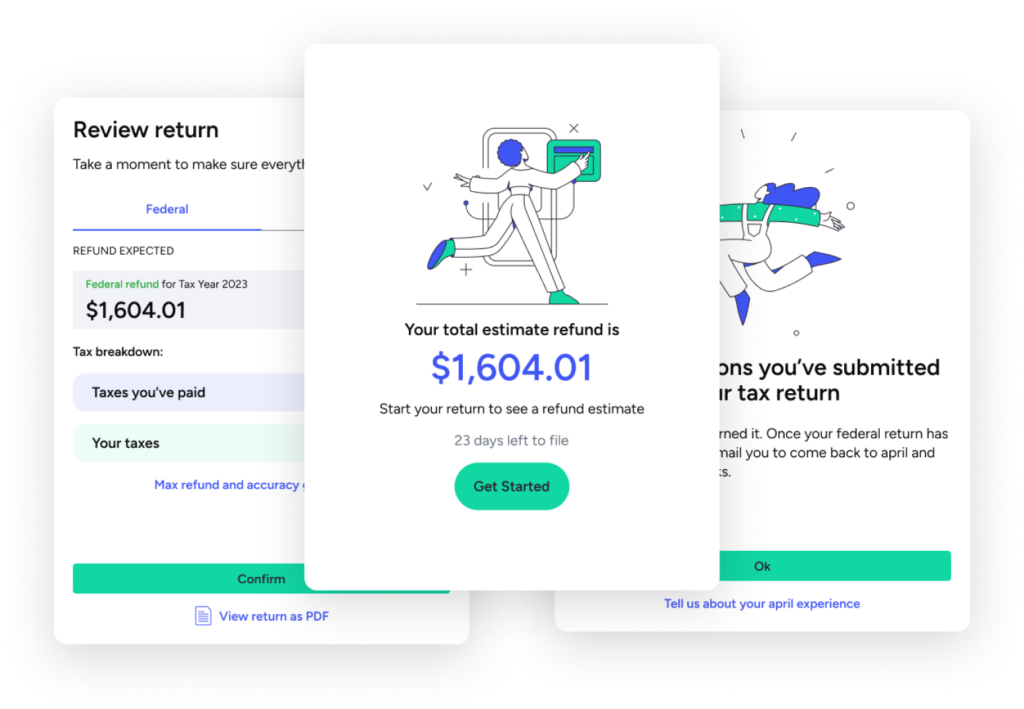

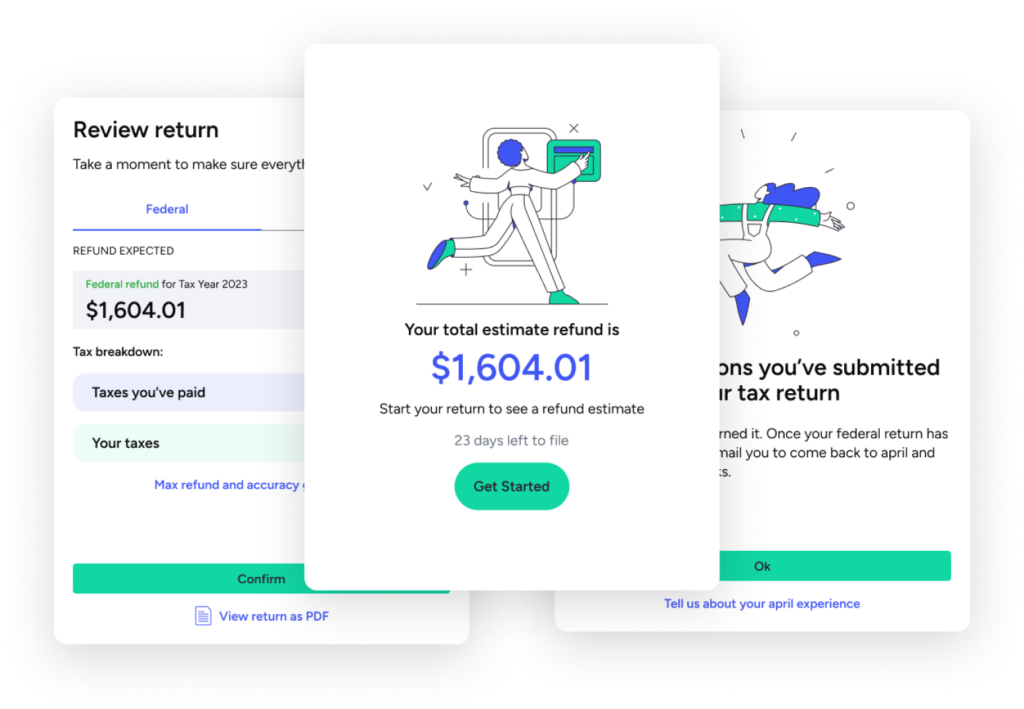

No more tab toggling between your crypto and tax platforms. We’ve partnered with april to make it easier to file.

Unlimited live support

Our customer support team is here to help you 7 days a week, including evenings, by chat or email.

Simple pricing

30 day money back guarantee

- Flat rate promise - Tax returns are one simple price for all, no upsells based on your tax situation!

- Support for W-2 and 1099 Earners always included

- Customers have access to live chat support 7 days a week during tax season

Why us?

Bringing the best features in one experience

We believe in simple. Saving time and money for customers is a win for everyone.

User centric experience

Intelligently skip irrelevant questions, making tax filing smarter and saving users valuable time. april serves as a tax translator, providing clarity on tax terms and opportunities for deeper learning.

AI-powered and user friendly

AI-powered features include Optical Character Recognition (OCR) form capture, simplifying the data entry process. Users can even upload a photo of their W-2 and previous year 1040, which april will prefill.

Maximum refund guarantee*

If you find an error that entitles you to a larger refund (or smaller liability), april will refund any fees you paid and you may amend your return with april at no additional charge. *Limitations apply; see below.

Written for humans, by humans

Helpful context is included to understand complex tax concepts in the tax prep user journey, and live support is also available.

| Features and benefits | Included in ZenLedger | TurboTax | TaxAct |

|---|---|---|---|

| W2 income | |||

| Self employment income | |||

| Mobile app | |||

| W2 mobile form upload | |||

| 1099 mobile form upload | |||

| Save previous year forms | |||

| Jump between sections | |||

| Live support | |||

| Student credits | |||

| State & federal | |||

| Stock transactions | |||

| Unemployment income | |||

*Comparing free and paid features of base TurboTax & TaxAct plans, as of 1/1/24

Unique tax scenario? We came prepared.

Health Savings Accounts (HSAs) deduction

Report the pre-tax dollars for your medical expenses.

Child and dependent care credit

Lower your tax bill while getting help with dependent care costs.

Student loan interest deduction

Student loan interest deduction: Deduct student loan interest to reduce your taxable income when you file your tax return.

Child Tax Credit (CTC)

Claim this tax credit for each qualifying child on your tax return, reducing your overall tax liability.

Education credits

Reduce tax liability by reporting certain education-related expenses.

401(k) contributions deduction

Lower your tax bill while getting help with dependent care costs.

Educator expenses deduction

As a school teacher or eligible educator, you can deduct up to a certain amount spent on classroom supplies.

Business expenses

Deduct eligible business expenses (including for multiple businesses), including home office, travel, and advertising, on your tax return to reduce taxable income.

FAQs

Frequently asked questions

ZenLedger has partnered with april to bring tax filing to our platform and maximize our customers ability to tackle their annual returns. april is an authorized IRS e-file provider and offers software to help you self-prepare and e-file your return.

Note: You are solely responsible for reviewing and verifying the accuracy and completeness of all data you’ve provided, inputted, imported, or uploaded. The filer does not provide tax, legal, financial, or other professional advice. If your situation is complicated, or if you would like more specific tax planning advice as to your particular situation, please consult a qualified tax advisor. We may provide live tax support as part of our service offering.

april covers many common, non-complex US resident tax situations – covering employees, independent contractors, gig-workers, families, standard tax credits and deductions, and more. You can find a full list of our supported use cases here.

All users filing with april this year, whether returning or new, will create new accounts. Whether you filed with april or a different tax provider last year, you can streamline your filing process and import key information by uploading your 1040 form (i.e. your tax return) from last year.

It’s easy to switch to Zenledger x april, no matter who you’ve filed with before. You can upload your 1040 form (i.e. your tax return) from last year at the start of the april filing process to import key information and streamline your experience.

If you find an error in the tax preparation that entitles you to a larger refund (or smaller liability), we will refund any fees you paid us to use our services to prepare that return and you may use our filer to amend your return at no additional charge. To qualify, the larger refund or smaller tax liability must not be due to differences or inaccuracies in data supplied by you, your choice not to claim a deduction or credit, positions taken on your return that are contrary to law, or changes in federal or state tax laws. If our tax preparation software makes a mathematical error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, we will reimburse you up to a maximum of $10,000.

If you receive an audit letter from the IRS or a state tax authority in connection with an accepted tax return filed through april, we will provide you with informational assistance, such as responses to frequently asked questions or links to resources on the IRS’s or other tax authority’s website. april will not represent you before the relevant tax authority or provide legal advice.

Fees paid cover april’s services and support in helping you self-prepare your taxes, not simply filing your completed return. If your completed return is rejected, there is often a way to review and correct the rejection, and april will provide you with instructions and assistance to do so. If your completed tax return still cannot be filed and accepted after following the instructions provided and working with april, please contact us.

Disclaimer: If you find an error in the tax preparation that entitles you to a larger refund (or smaller liability), we will refund any fees you paid us to use our service to prepare that return and you may use our service to amend your return at no additional charge. To qualify, the larger refund or smaller tax liability must not be due to differences or inaccuracies in data supplied by you, your choice not to claim a deduction or credit, positions taken on your return that are contrary to law, or changes in federal or state tax laws.