#1 Cryptocurrency Tax Software

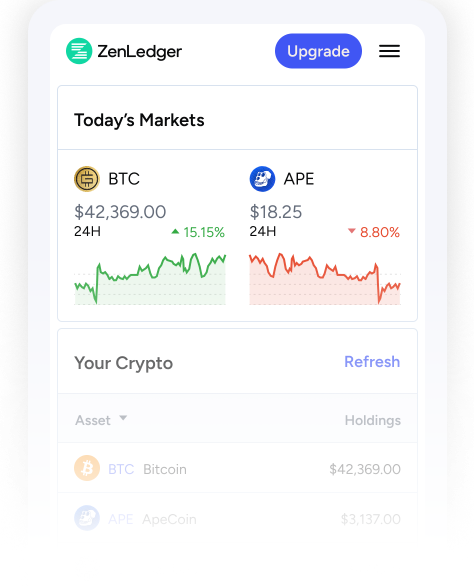

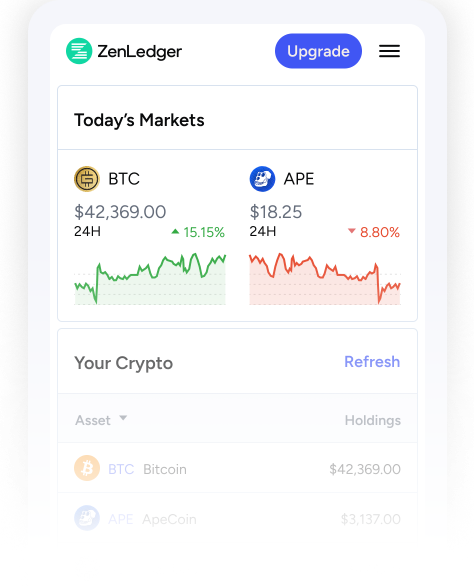

Crypto tax made simple

Calculate your DeFi, NFT, & crypto taxes plus file your state and federal taxes all without ever leaving the app.

Trusted By

Rated best crypto tax software for tax professionals by Fortunly

Tax filing made simple

Tax professionals

Easy as 1,2,3

Crypto taxes made simple

01

Import your exchanges

02

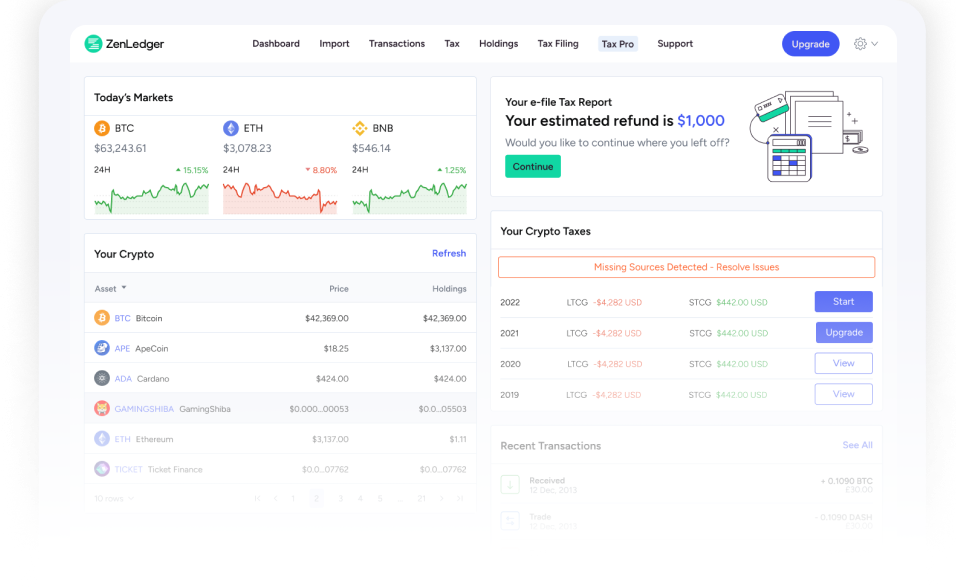

Review your transactions

Easily calculate your capital gains and losses, and view tax liability for every cryptocurrency transaction.

03

Download your forms

After reviewing your reports and ensuring accuracy, the final step is to generate your tax reports and file them!

Advanced Tools And Resources

Reasons to love ZenLedger

Pricing

The best pricing in the industry, including a free plan.

Tax filing

One Tax Return. One Platform Experience. No more Tab Toggling.

Premium support

Our customer support team is here to help you 7 days a week, including evenings, by chat, email, phone or video calls.

Tax loss harvesting tool

Save money and trade smarter. Detailed report included in all plans.

Grand Unified Spreadsheet

See all your transaction details in one, easy to read spreadsheet.

Security and encryption

We care deeply about your privacy and offer 2FA (two-factor authentication).

Premium support

Our team have a passion for helping our clients get their taxes done right

- Get a response in just a few minutes

- FAQ articles available in our robust online help center

- Support via phone, video, or chat with our in-house experts

As Seen In

Still not sure? Our customers say it best.

Exchanges and Integrations

Over 400+ exchanges, 100+ DeFi protocols, and 10+ NFT platforms.

ZenLedger’s crypto tax tool supports more exchanges, coins, wallets, blockchains, fiat currencies, and DeFi & NFT protocols than our competitors, and we are always adding new integrations.

Crypto tax guides

FAQs

Frequently asked crypto tax questions

Each time a crypto asset is acquired, mined or received for a profit, the gains automatically qualify as capital gains. According to the IRS, crypto assets are treated as property and hence, are taxable. So your capital gains will also be taxed accordingly and are known as capital gains tax. Capital gains can be calculated using the formula:

There is no way that you can avoid paying crypto taxes to the IRS. However, you can minimize your tax obligations in a few ways. If your losses outweigh your gains, you can offset $3,000 of income, as well as take advantage of the lack of wash sale rule using tax-loss harvesting.

The rate of tax on your crypto profits depends on two crucial factors: the holding period of the assets and income brackets. Based on the holding period, crypto gains can be of two types. Short-term capital gains taxes, where assets are held less than a year and the rates range from 10% to 37%. Next are long-term capital gains taxes, in which the assets are held for over a year before selling them. In this case, the rate of taxes ranges from 0% to 20%, depending on your income.

Cryptocurrency is taxed the same way as property. So whenever you’re disposing of an asset for another asset, you’ll be liable to pay taxes, based on the transaction that you carry out. Your transaction can be categorized into two types of taxable events: capital gains taxes and income taxes. And again, there are some transactions that are tax-free. So, depending on the transaction you’ll have to report your crypto gains to the IRS.

Crypto tax software helps you by tracking, managing, and calculating the gains or losses on your crypto transactions. Your funds are not accessible through crypto tax software, they are read-only, so this keeps your assets safe from hacks or theft.

ZenLedger is the best crypto tax software. You can not only generate your crypto tax reports but also track your asset portfolio. And not just that, one can easily contact customer support to help with any questions. ZenLedger currently supports over 400+ exchanges, 7000 token types, 20+ DeFi protocols, ERC-721 NFTs and all wallets. We are also racing to integrate additional exchanges, wallets, blockchains and protocols daily, and will soon have support for more NFT standards.