Cryptocurrencies, freed from the pages of futuristic sci-fi novels, have gone from the mysterious Satoshi Nakamoto’s hobby project to a mainstream investment in just ten years. Despite the growing popularity of digital currency, IRS guidance and FINRA regulations have yet to catch up. This delay has created a golden opportunity for Certified Public Accountants (CPAs) to guide crypto-investors through the often murky waters of Federal and State tax compliance.

Let’s dive into our comprehensive crypto tax guide created for tax professionals and CPAs so you can help your clients with their crypto taxes and better understand crypto.

Who Invests in Crypto?

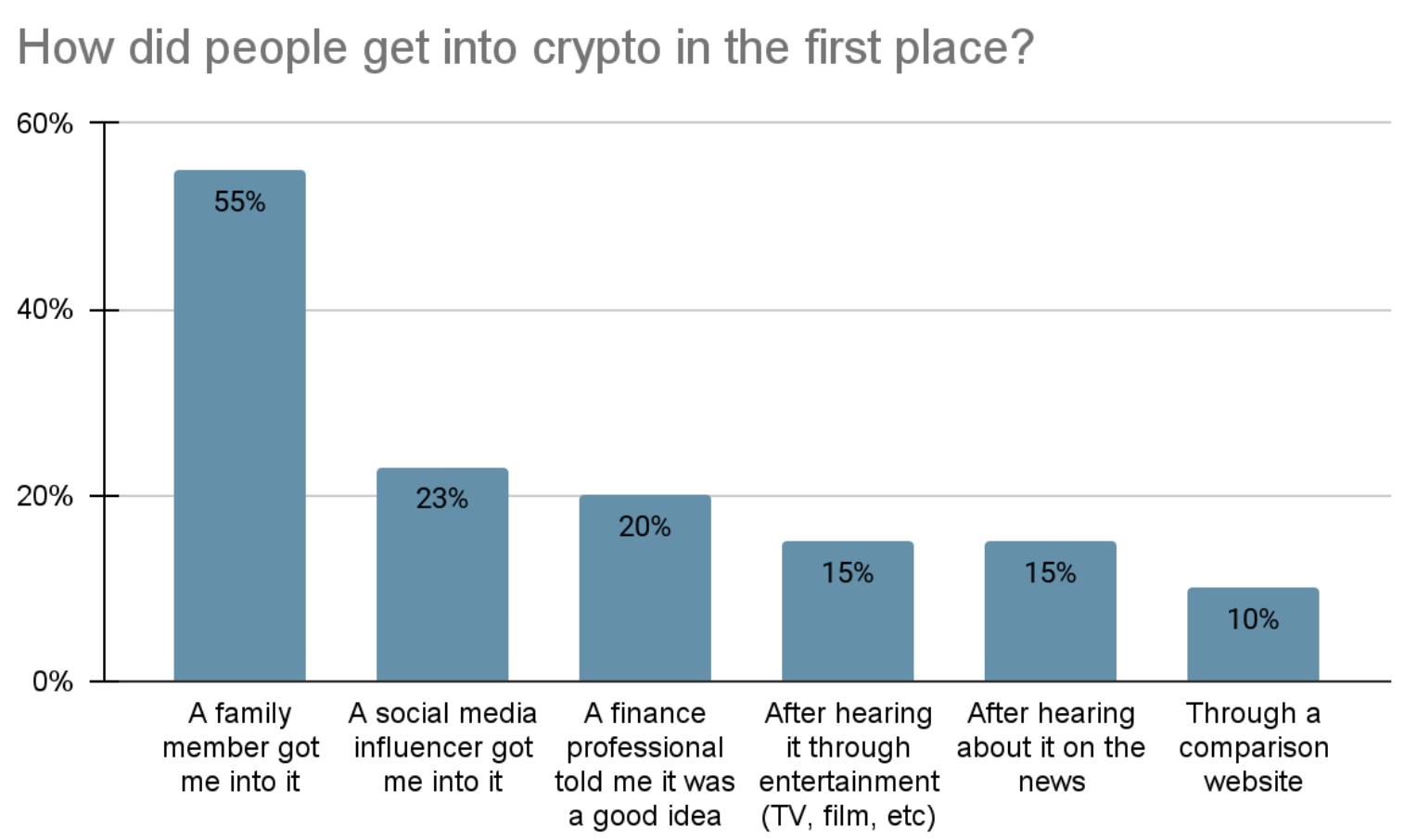

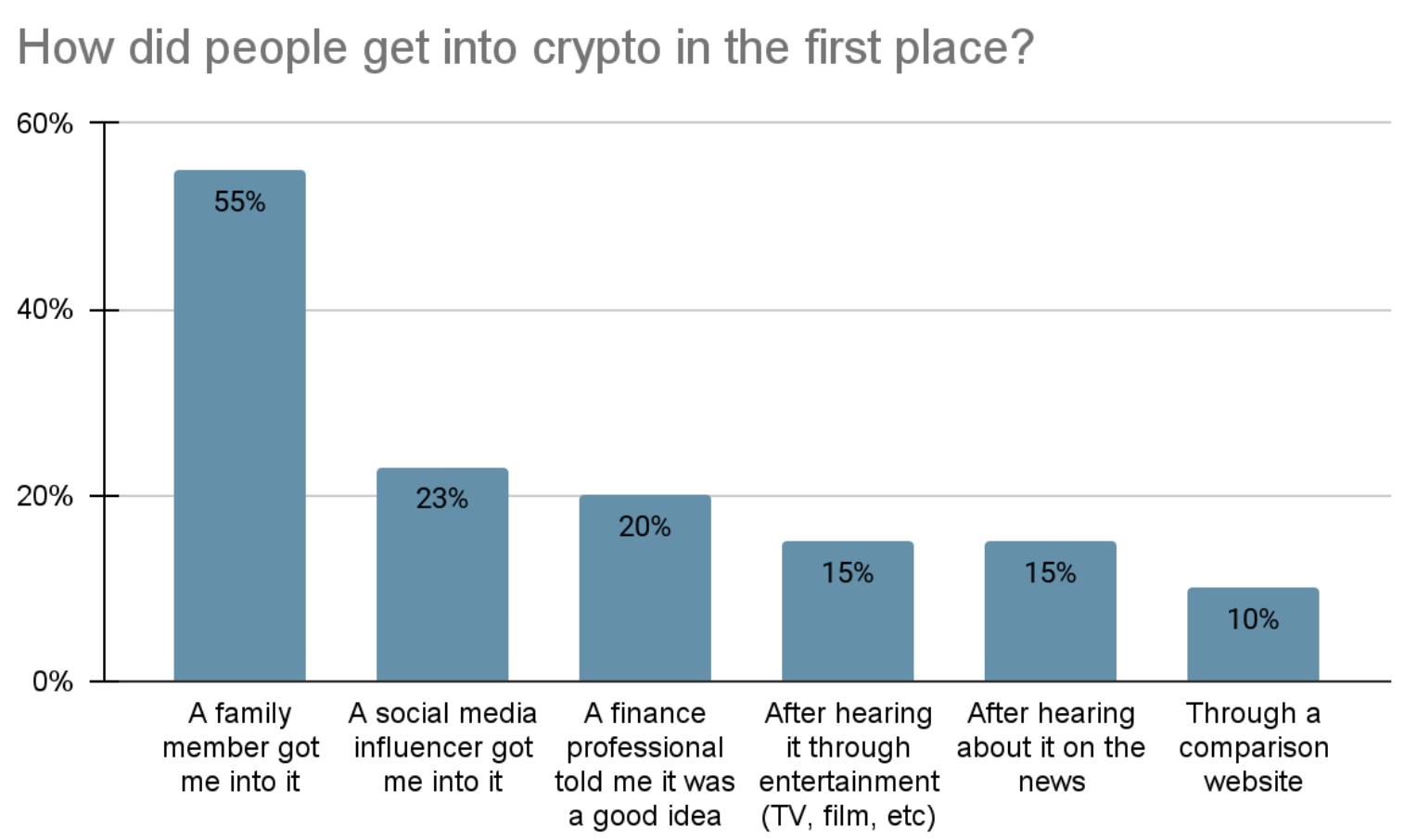

The stereotypical early Bitcoin user was a tech-savvy, privacy-obsessed, middle-aged male with a mild distrust of centralized banking. Today’s crypto-owners are far more diverse! According to a 2022 NBC News survey, 21% of American adults have owned crypto, with ages ranging from 18 to 80. And we expect this number to grow! In a 2023 study by Bitwise, 90% of financial advisors said their clients asked about crypto.

According to Forbes Advisor survey, there are several reasons people invest in crypto:

- It’s an easier way to start investing through an app (42%)

- It’s easier to understand than conventional investments (34%)

- Investors believe in the message and mission statement behind crypto (30%)

- Investors have easier access to money when it’s invested in crypto (27%)

- Investors see their friends or family members investments performing well (26%)

- Investors trust it more than traditional investments (24%)

- Investors made more money through crypto than traditional investments (21%)

How to Find and Attract Crypto Clients

Ask Your Existing Clients

Often, clients who hold crypto don’t know the tax implications of their digital investments. If they are not on the Bitcoin bandwagon, they might have a friend who is.

Offer Virtual Tax Prep

Virtual tax prep can expand your potential reach, which is especially appealing to «HENRY» (High-Earning, Not Rich Yet) younger generations who are comfortable with technology.

Consider A La Carte Prep

Some clients might seek help on the cryptocurrency portion (i.e., Schedule B, Schedule D, Form 8949, FinCEN 114 (FBAR), FATCA 8938, and misc. income) while maintaining the status quo, such as self-prep, on the remainder of their tax return.

Use SEO (Search Engine Optimization)

SEO can help drive traffic for crypto-tax topics. Maintaining a keyword-heavy blog or hosting free webinars can help establish credibility for your firm and showcase your expertise.

Partner With a Cryptocurrency Social Organization

Offer free consultations or an affordable package for tax prep to Meetup clubs, Facebook Groups, or other organizations.

Use a Payment Processor

Use a payment processor like BitPay or Coinbase Commerce to accept popular digital coins as payment.

The Reality of Crypto Tax Prep

Tax preparation for traditional investments like stocks, bonds, and real estate is primarily a matter of understanding and applying the relevant tax treatment. Sounds easy enough! But because digital currency is relatively new, cryptocurrency taxation is sometimes a foray into uncharted waters.

Digital Currencies Have Not Found a Permanent place in the Tax Code

While the IRS has offered some guidance on the topic, the regulations are not nearly as clear as they could be. For example, the IRS has made it clear that it considers cryptocurrencies “property” from a tax standpoint (despite the term “currency” in the name). However, the rules and regulations surrounding cross-chain bridges and staking remain ambiguous.

This point segues nicely into the second point.

Cryptocurrency Taxation Requires Meticulous Tracking!

Every sale, trade, fork, purchase, and gift will eventually reach the 1040. Exchanges and wallets have yet to begin producing the neat and tidy 1099s that brokerage accounts send each year, so traders must track on their own. In the highly volatile cryptocurrency market, it is not uncommon for investors to diversify – holding dozens of types of coins (e.g., Bitcoin, Litecoin, Ethereum, the thousands of ERC-20 coins) in dozens of exchange and wallet accounts. Even dedicated «Hodlers» or rookie hobbyists find themselves with hundreds of transactions each year, trading coins for other coins, self-transferring to other accounts, forking into new currencies, or randomly air-dropping into their possession.

Crypto Owners Need Experts to Help Navigate Tax Season

To further complicate matters, many cryptocurrency transactions technically occur in foreign jurisdictions since major exchanges (e.g., Bittrex, Poloniex, Binance, etc.) are all across the globe. This distinction triggers filing requirements for FBAR and other disclosures. As the IRS threatens to crack down and tighten up, word is spreading within the crypto-community that tax compliance is no longer optional. These potential clients seek trained CPAs’ help to amend previous returns and establish a consistent filing record going forward.

Smooth Sailing

During tax season, CPA firms struggle to find enough qualified staff to handle the numerous engagements, and existing staff are often under enormous pressure to work overtime as the deadline approaches.

At first glance, the thought of taking on a new line of work and developing expertise in a new industry sounds overwhelming, considering the existing problems that CPA firms face.

Offering crypto tax services doesn’t have to be complicated; with the right software, such as ZenLedger’s world-class platform, preparing and filing taxes on cryptocurrency investments is simple and (most importantly) automated.

ZenLedger Product Features

- Manage multiple clients under a single log-in

- Connect to wallets and exchanges via API zenledger.io

- Up-to-date FMV – no more manual lookup of crypto prices

- Completely automated calculations

- Basis tracking is built-in

- Detailed audit reports for troubleshooting & transparency

- Tax-loss Harvesting reports to minimize client tax liability

- Customize and edit forms before printing

- Export results to CSV for import into your tax program

- No subscription fees

- Thorough documentation for easy onboarding

- Prompt customer support via phone, chat, and email

- Plus, an in-house CPA who can guide you through it all

Free Account for Tax Professionals

Set up a free ZenLedger Tax Professional account. Take a look around. Dive into our training materials. Be ready for your first crypto client in less than you spend on hold with the IRS.

Glossary

Address

A long alphanumeric string that uniquely identifies a wallet on the blockchain while preserving the anonymity of the wallet’s owner. Similar to an account number.

Airdrop

These are free coins sent en masse to random wallet addresses, normally to artificially grow a new coin’s user base.

Altcoin

Any coin that is not Bitcoin, as they were all created with hopes of becoming the better replacement for Bitcoin.

Blockchain

See Ledger below.

Cryptocurrency

A decentralized digital currency. Ex: Bitcoin, Ripple.

ERC-20

One of the 3000+ altcoins that use the Ethereum blockchain. Popular ones include TRON (TRX), Maker (MKR), & Basic Attention Token (BAT).

Faucet

A website that uses visitors’ computer processing power to mine coins. In return, it splits the mining reward among all website visitors. Unfortunately, this is often a scam.

Fiat

Currency that is centrally controlled by a government. Ex: USO, EUR.

Fork

A split in the blockchain where you upgrade coin holdings to a new protocol, so existing coin owners receive an equal amount of the new coin. It can be a hard (old coins become invalid) or soft (maintains backward compatibility) fork. A popular example is the Bitcoin Cash (BCH) fork, which occurred in August 2017 on the Bitcoin (BTC) blockchain.

Hardware Wallet

A physical place to store digital currency – often looks like a USB stick. Ex: Ledger Nano, Trezor, KeepKey.

Hodl

A slang term in the crypto community that was initially a typo of <> on an early crypto forum. It is also an acronym for <>, perfectly illustrating the meaning.

ICO

Initial Coin Offering. Similar to an IPO, it is the public introduction of a new cryptocurrency that seeks to generate excitement and raise funds.

Ledger

Another word for the blockchain. It is a constantly updated, decentralized, and permanent record of all transactions in a particular cryptocurrency.

Mining

Cryptocurrency coins are <> when a miner’s computer can successfully calculate an alphanumeric key. The miner will receive a small portion of the coin as a reward for their work.

Satoshi

AKA <>. Equal to 0.00000001 BTC, it is the smallest unit of Bitcoin.

Named after Satosho Nakamoto, the inventor of Bitcoin.

Staking

A process of <> coins to help verify other transactions. Stakers receive a small portion of a coin in return for their service.

Token

Another name for a coin.

Learn More

ZenLedger quickly calculates your clients’ crypto taxes and also finds opportunities for them to save money and trade smarter with our portfolio tracker. Get started for free now with our tax professional suite product to see how easy it is to track your clients with our simple dashboard!

Disclaimer: This material has been prepared for informational purposes only and is not intended to provide tax, legal, or financial advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.